Crypto Lending with Walawong API

Cryptocurrencies have entered the mainstream, and they are redefining financial transactions. Today, these digital assets are lent and borrowed. This industry is making waves, partly because the process has many advantages over fiat loans. Before we dive into crypto lending, let us first understand how traditional lending works.

What is Traditional Lending?

Since the introduction of modern banking, lending has played a big role in most countries’ economic development. Simply, a lender provides money, property, or other assets to a borrower and the borrower needs to return or repay the assets in the future.

When a borrower requests a loan, an endless bevy of paperwork is what comes upon them. They will need to fill in forms, get documents attested, submit photocopies all pertaining to their financial status. Lenders provide borrowers with loans in cash (fiat money) with an interest rate charged to the loan amount. Evidently, this interest serves as a lender’s fee for the loan.

Traditionally, the bank facilitates the entire process and acts as the primary authority in the transaction. These financial institutions bring lenders and borrowers together. Most banks rely on a fractional reserve banking system where a percentage of bank deposits serves as credit for borrowing customers at any given point in time.

The major drawback of this system is that if the majority of customers withdraw their money at the same time (also known as a bank run), the bank might not be able to reimburse the majority of its customers all at once due to insufficient reserved funds.

So How Does Crypto Lending Work?

Instead of using fiat money, crypto lending involves the use of cryptocurrency. These digital assets are built on decentralised blockchain technology which makes them more transparent, tamper-resistant, and pseudonymous. In addition, most cryptocurrencies aren’t controlled by the government and can be sent worldwide via a blockchain protocol.

As crypto adoption accelerates, especially among millennials and Gen Zs, crypto lending platforms have emerged to facilitate financial activities across the decentralised economy. It enables the utility of digital assets by securing crypto as collateral against loans.

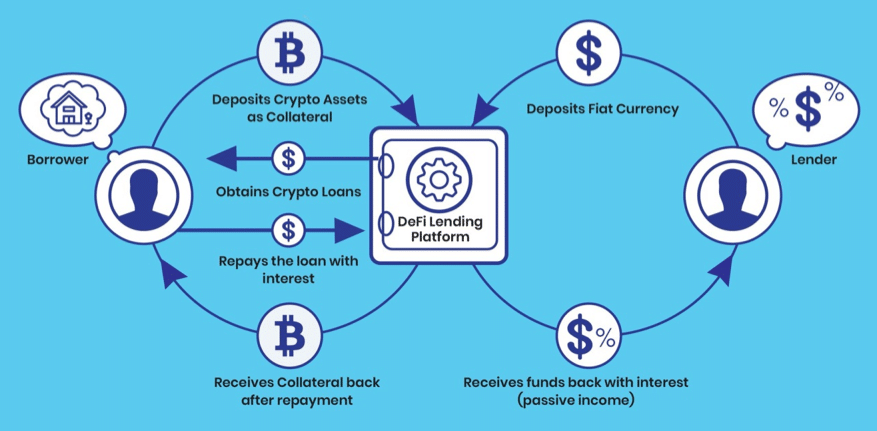

Borrowers take on the responsibility for depositing crypto assets in the form of collateral for securing the lender’s investment. The lender would receive the interest from borrowers in return for the loan and have an assurance of the collateral. In the event that the borrower fails to repay the loan, the collateral can compensate the lender.

How Can Your Business Benefit from Crypto Lending with Walawong API?

As cryptocurrency adoption is on the rise, these digital assets are usually just stored in crypto exchanges and wallets. Including crypto lending as part of your business product offering can potentially mitigate default rates or penalty rates associated with non-collateralised lending while also earning interest on top of the loan amount.

Moreover, this offers financing flexibility to your customers which consequently maintains customer retention. Not only that, your target audience further expands since millennials, Gen Zs and the younger generation, Gen Alpha are more receptive to having cryptocurrencies as part of their investments rather than conventional investments.

Just like traditional lending, applicants are required to submit their financial documents for financial status screening. Once you’re connected to Walawong, you can immediately retrieve your customers’ crypto data that can assist you in determining whether the applicant suits a particular loan product and the amount of loan to be disbursed.

Walawong can also help you verify whether a particular crypto wallet address actually belongs to the loan applicant to ensure that they have enough digital assets to be put up as collateral.

Start building your crypto lending solutions with Walawong today.

Are you a developer or an aspiring entrepreneur interested in using Walawong? Request for a demo today and we’ll get back to you right away.

Prefer to chat live? Talk to us and stay up to date by connecting with us on LinkedIn or email us at support@walawong.com.